Understanding Tax

- Home

- Managing The Finance Of Your Business

- Understanding Tax

Understanding Tax

Tax Act 1967

Year Assessment (YA)

Income is assessed on a current year basis. The YA is the year coinciding with the calendar year, for example, the YA 2017 is the year ending 31 December 2017.

The basis period for a company, co-operative or trust body is normally the financial year ending in that particular YA. All income of persons other than a company, co-operative or trust body, are assessed on a calendar year basis. For example:

Chargeable Income

In general, a taxpayer is required to pay tax on all kinds of earning, including incomes from:

- Business or Profession

- Employment

- Dividends

- Interest

- Discounts

- Rent

- Royalties

- Premiums

- Pensions

- Annuities

- Others

Thus, gains or profits from carrying on a business are subject to tax.

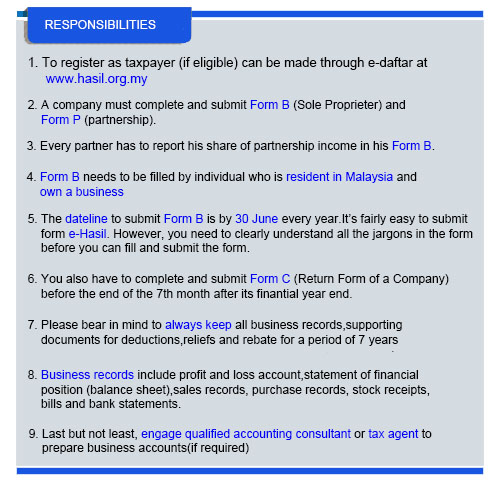

Tax Computation

Tax computation starts from your business income statement that has been prepared in accordance with Malaysia Accounting Standard. For a company, an audited report must be available before the computation of tax.

In deriving to chargeable income, Section 5 of the Act, has set up the scope of chargeable income, begins with the determination of basis period, ascertainment of gross income, adjusted income, statutory income, aggregate income, total income till chargeable income.

Gross Income Includes:

-

- Cash receipts from the sale of goods or from services provided.

- All debts incurred from the sale of goods and services provided.

- Receipts in kind.

- Recovery of bad debts.

- Insurance compensation received for business loss.

- Withdrawal of business stock or stock that was taken for personal use.

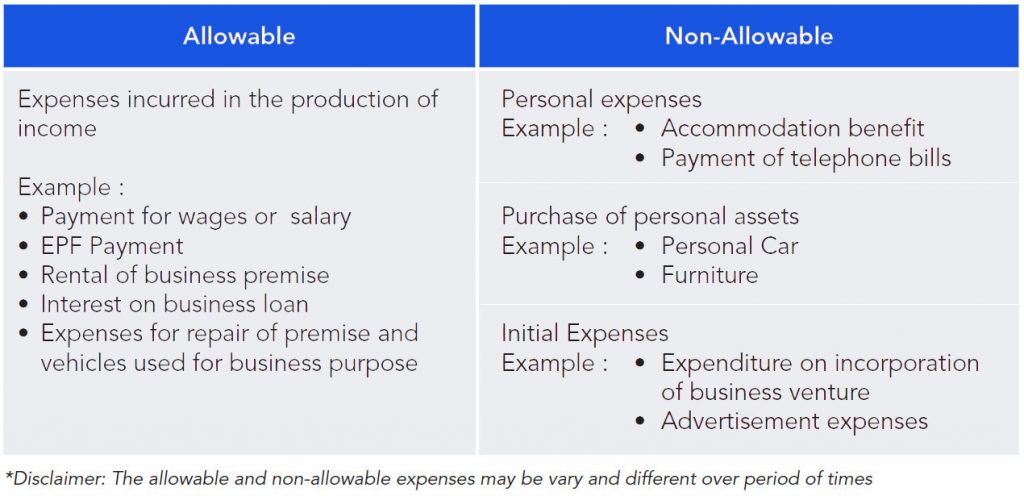

Adjusted Income From Business Source Is Derived From Gross Income After Deduction Of Business Expenses Such As:

-

- Allowable business expenses

- Allowable specific expenses

- Double deduction expenses allowable under Income Tax Act 1967

Business Expense Has To Fulfill All The Following Conditions In Order To Secure A Deduction From The Gross Income Of A Business Source:

-

- Each business source has to be accounted separately,

- Scope of expenses refers to “outgoings and expenses”

- Expenses have to be “wholly and exclusively”

- Incurred in the production of gross income from business source

Example:

Special Deduction (Specific Expenses)

Section 34(6) has been specifically legislated to allow certain specific expenses an income deduction notwithstanding such expenses do not satisfy the allowable business expenses criteria. These expenses are encouraged by the Government as they can achieve some national objectives or bring social benefits to the public.

-

- Expenditure incurred in providing equipment for the disabled employee (OKU).

- Expenditure incurred in respect of publication in National Language.

- Donation to libraries.

- Expenditure incurred in providing services, public amenities and contribution to a charity or community project.

- Expenditure incurred in providing and maintenance of a child care center for the benefit of employees.

- Expenditure incurred in establishing and managing a musical or cultural group.

- Expenditure incurred in sponsoring any art or cultural event.

Double Deduction

Certain expenses are given double deduction incentives for each relevant year of assessment.

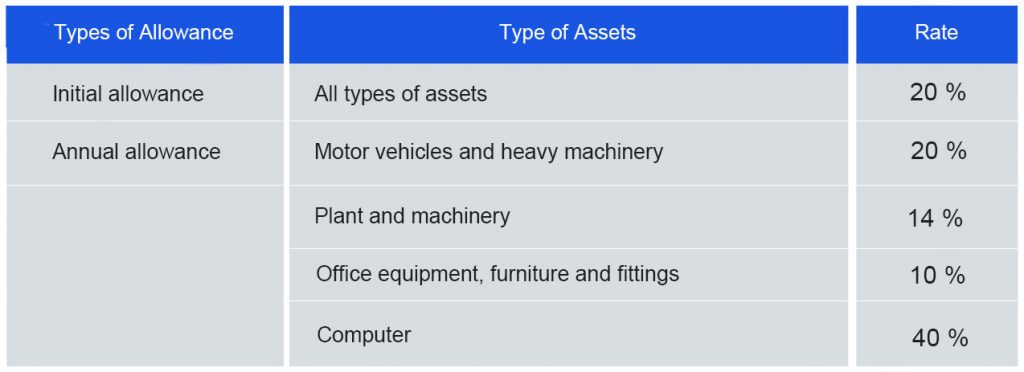

Capital Allowance

Given as deduction from business income in place of depreciation expenses incurred in the purchase of business assets.

-

- Examples of assets used in a business are motor vehicles, machines, office equipment, furniture and computers.

- Conditions for claiming capital allowance are:

- Operating a business

- Purchase of business assets

- Assets are being used in the business

- Owner of the assets

- Rates are determined according to the types of assets.

- Types and rate of Capital Allowance are as follows:

Approved Donation

An approved donation is stipulated under Section 44(6) of the Income-tax, 1967. The gift of money made to the Government, State Government, local authority or an approved institution or organization shall be given a deduction in arriving at total income.

The amount of cash donation to approved institution or organization is to be limited to 10% of the company’s aggregate income for that year.

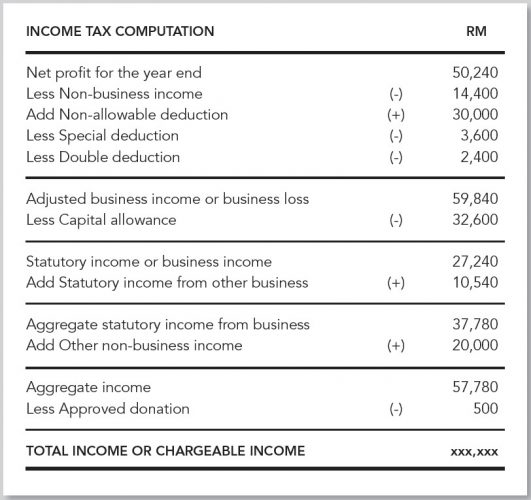

Example of Tax Computation Format Would Be:

Tax Rate Of Company

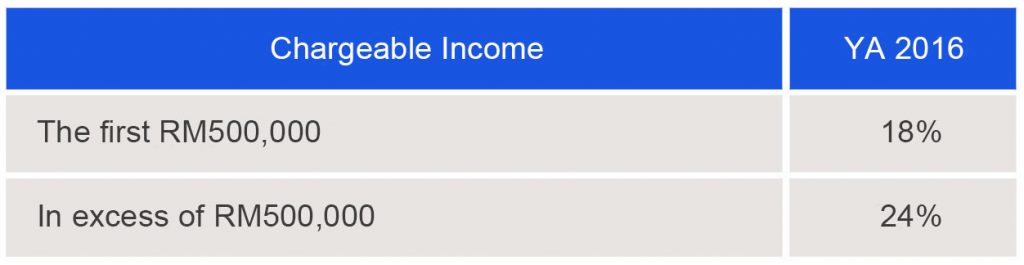

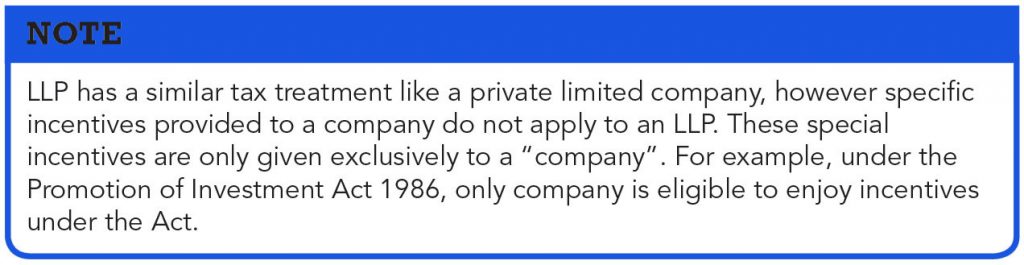

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. Companies are taxed at the 24% with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM2.5 million are taxed as follows:

Tax Rate For Sole Proprietorship Or Partnerships

The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. In the case of sole proprietorship, business chargeable income is his or her individual income.

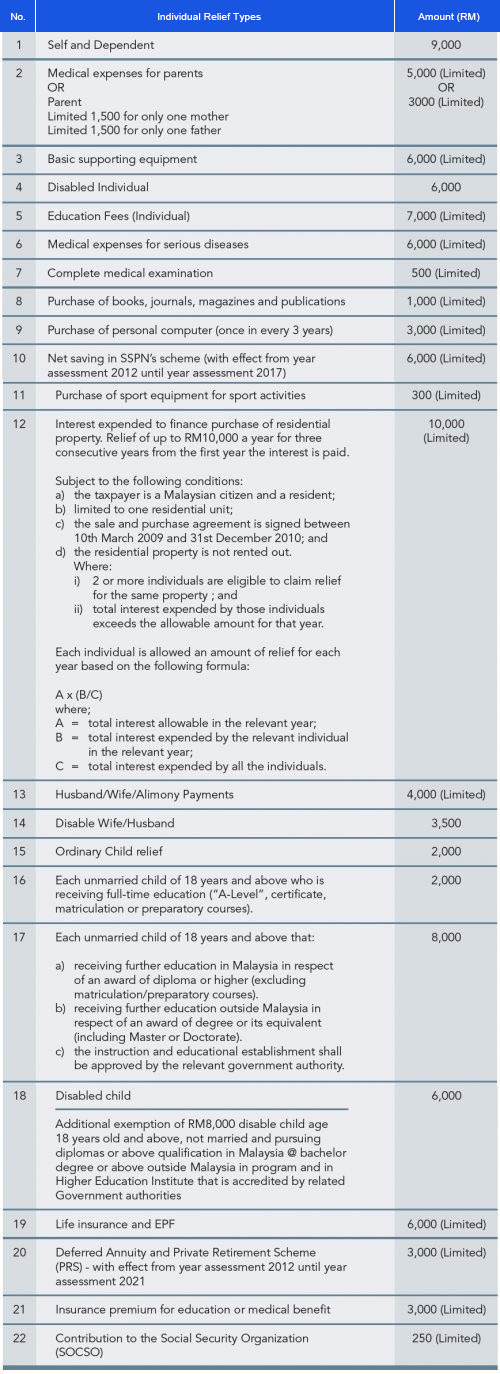

Whereas in partnership the chargeable income is divided among the partners as an individual. As an individual, sole proprietor or partner are entitled to the following reliefs;

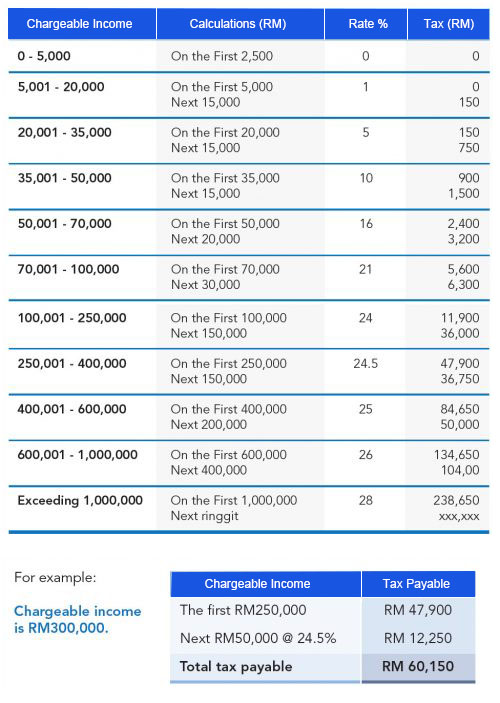

The total relief available are then set off against the total income / chargeable income from the business to arrive at chargeable income which is taxable according to the tax rates:

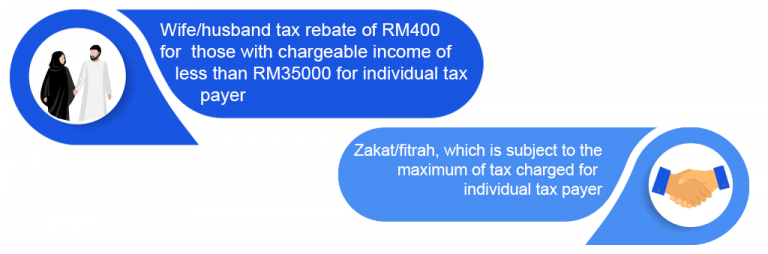

Tax Rebate

Tax rebate is deducted from the actual taxed amount. There are two types of tax rebate applicable.

Categories Of Taxes In Malaysia

There are two different kinds of taxes in Malaysia which are a direct and indirect tax. A direct tax is a tax that is levied on a person or company’s income and wealth. The tax is paid directly to the government. Examples of direct tax are income tax and real property gains tax. The statutory body who is in charged with the direct tax is the Malaysia Inland Revenue Board (LHDN).

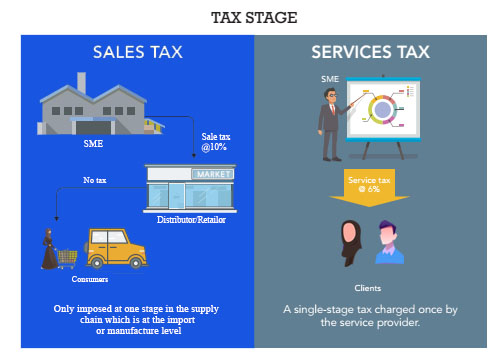

Meanwhile, indirect tax is referred to as tax excised to a person who consumes the goods and services and is paid indirectly to the government. Examples of indirect tax are Goods and Services Tax, Service Tax and Sales Tax. The government body who is responsible for the indirect tax is Royal Malaysian Customs Department (RMCD).

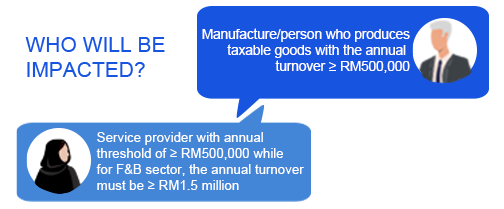

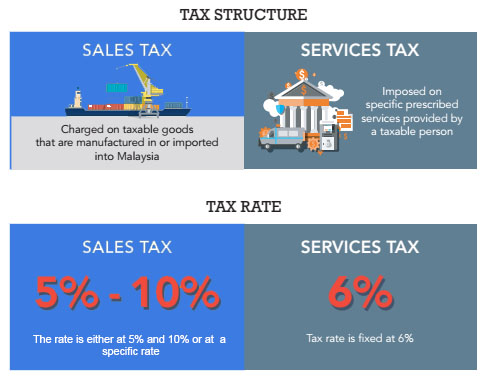

Sales & Service Tax (SST)

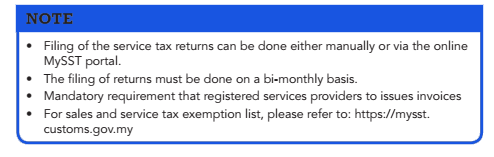

The Sales and Services Tax (SST) legislation came into effect on 1 September 2018 replacing the Goods and Services Tax (GST) Act 2014. SST is a single-stage tax, where the sales tax is charged upon taxable goods manufactured and sold in Malaysia as well as those imported into Malaysia. Service tax is charged on taxable services provided in Malaysia and imported services.

The above is correct on 14th October 2021