Bookkeeping – Anticipant Your Accounting Cycle

- Home

- Managing The Finance Of Your Business

- Bookkeeping – Anticipant Your Accounting Cycle

Bookkeeping

Anticipate Your Accounting Cycle

Bookkeeping

The main objective of starting a business is definitely to reap a profit. Many startups failed within 3 years of establishment due to poor financial management and no proper bookkeeping.

It is important for entrepreneurs to have a proper recording of business transactions; income and expenses to determine whether your business is operating at a profit or at a loss. Knowledge of basic bookkeeping will ensure the consistency of your business financial reporting.

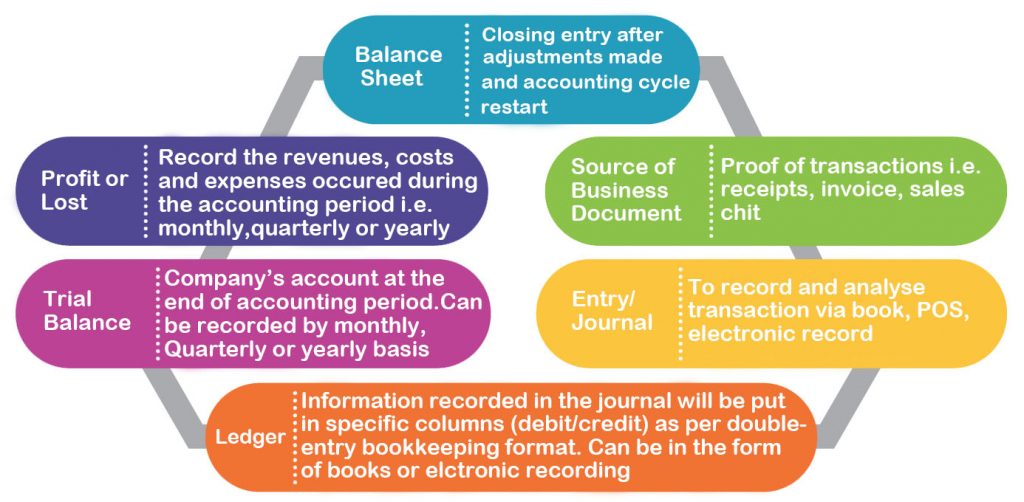

Your daily business operations can be recorded based on this simplified accounting cycle as below:

Cashbook

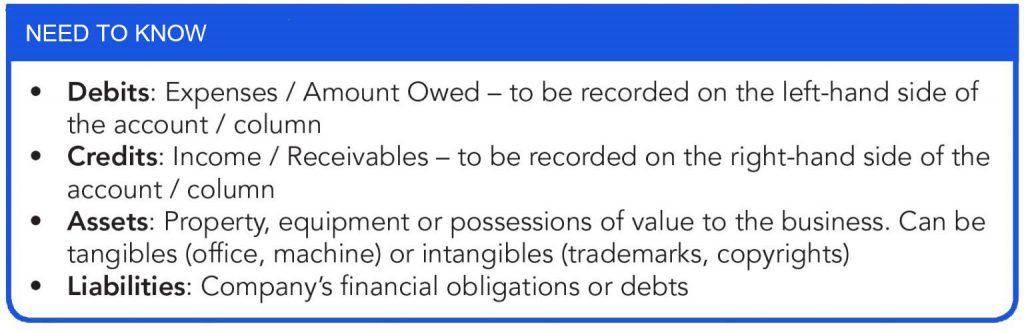

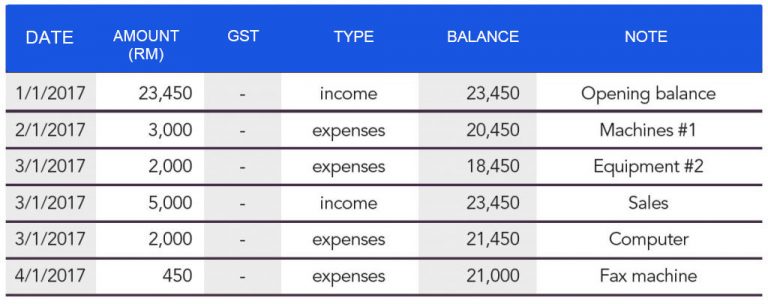

The basic accounting system would be keeping a cashbook record. It is important to keep all your record of expenses and original documents such as bills, invoices, receipt, payment and sales voucher as a proof of the statement of your entry in your cashbook. From this cashbook, later on, you will transfer all the data to your business account for the monthly statement. For small business entrepreneurs normally they just use a cashbook to manage their daily transaction.

This Toolkit will teach you how to prepare and maintain a simple cashbook recording. The cashbook will help to analyze your income and as well as determine your tax and GST returns. A good cashbook can be in a manual or electronic format, but must be easy to use and does not take up too much of your time to understand. The manual cashbook example explained here serves as a guide, shows a few entries, but understanding its operation will give you a basic understanding of a computerized cashbook.

Cash Flow From Operating Activities

The cash flow includes activities from generating principal revenue such as a purchase of goods and services and sales. It can be computed using two methods which are Direct and Indirect Method.

Direct method

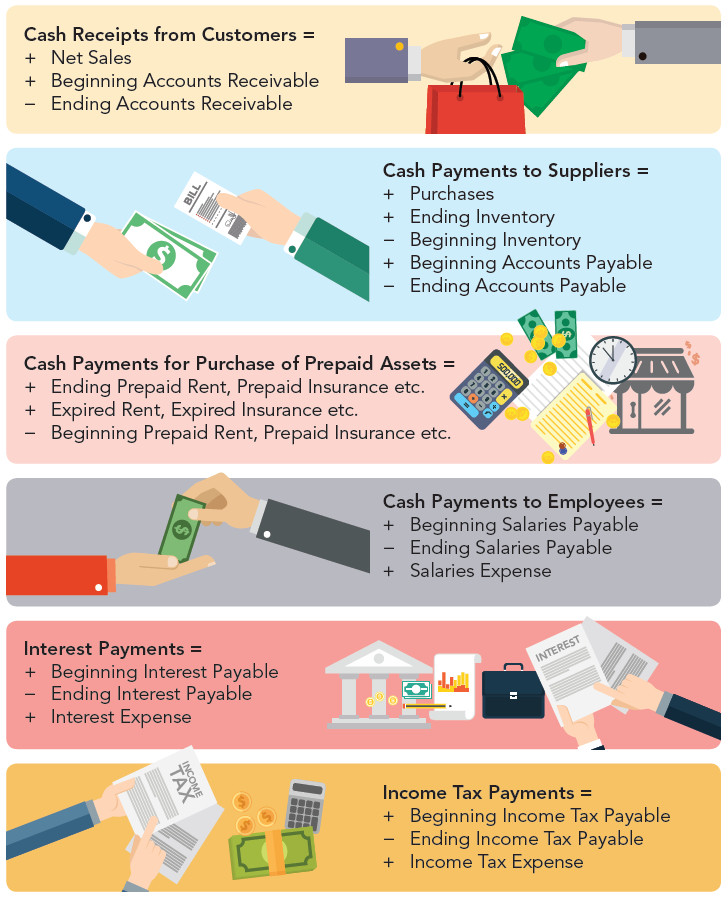

The direct method is to record all operating activities that involve various types of cash receipts and payments such as cash paid to suppliers, cash receipts from customers, salaries etc and then putting it together into the operating section of a cash flow statement.

Example of cash inflows and outflows calculations are as follows:

Indirect Method

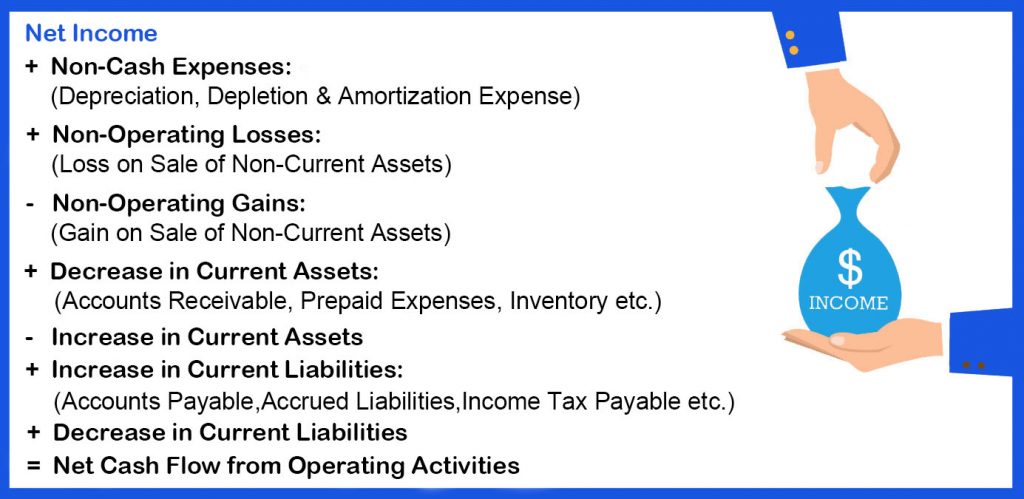

In the indirect method, the amount of net cash flow from operating activities is calculated by using the net income figure from the income statement. It uses net income as a starting point makes adjustments for all transactions for non-cash items, then adjust for all cash-based.

The following is the indirect method formula to calculate net cash flow from operating activities:

Statement Of Cash Flow Forecast

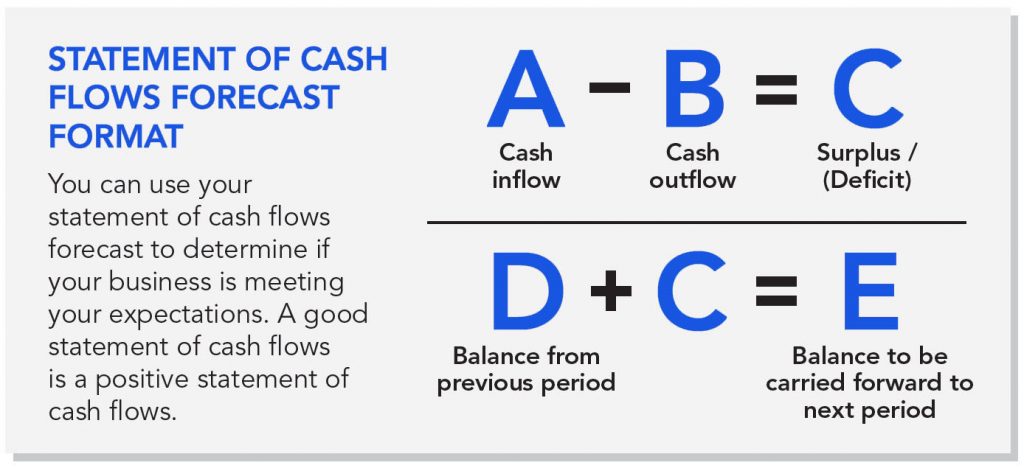

A statement of cash flows forecast shows the estimation of money flow in and out of a business. This includes all projected income and expenses over a period of time. Statement of cash flows forecasting is a very important and useful tool for an entrepreneur. It will help entrepreneurs in budgeting and plan their expenses commitment and payment to relevant parties.

We have already projected the amount of money that is needed to start a business i.e. the “outflow” for ABC Enterprise. We also have to project how much money will come in through business activities i.e. sales or additional cash injected. Amounts forecasted from sales should be shown with the accurate expected period under “inflow”.

In statement of cash flows forecast, only cash sales and cash expenses are taken into account.

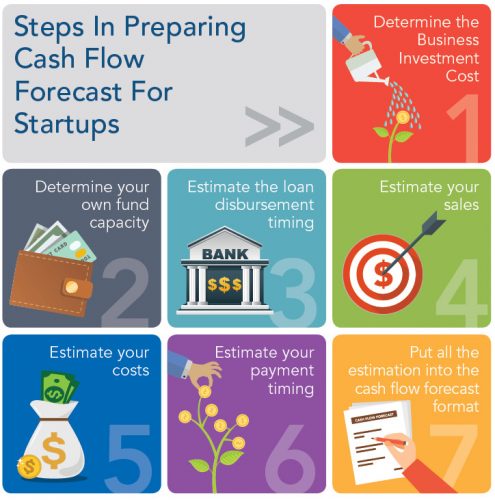

Determine Your Own Fund Capacity

State your own fund capacity

Estimate The Loan Disbursement Timing

Business might apply for a loan and the process might take some time. The timing of the cash inflows from the loan will greatly affect your cash flow forecast

Sales Estimation

A sales estimation is a plan of how much you expect to sell in the future, normally broken down by month. For a startup business, you’ll need to estimate your forecasts based on information from customer surveys, market research, suppliers, industry experts, the performance of similar businesses and the capacity of your business operation. For a mature business, sales estimation can be based on the sales history or trends.

Payment Timing

It’s important to understand that the timing of cash inflow and cash outflow comes down to the operating cycle of your business. This involves the timing of buying and selling, sales collection time, credit payment terms and specific time payment commitment.

Cost Estimation

Cost estimation is a forecast of all expenses that a business may incur. It can be estimated daily, monthly or annually

Let’s Assume ABC Enterprise Has The Following Estimations For A Year:

- Business investment cost: RM74,232

- Own fund capacity for start-up: RM15,000

- Loan application: RM50,000

- Staggered loan disbursement:

1st Month: RM15,000

3rd Month: RM10,000

5th Month: RM25,000 - Loan repayment will start on: 7th month for RM1,500 / month

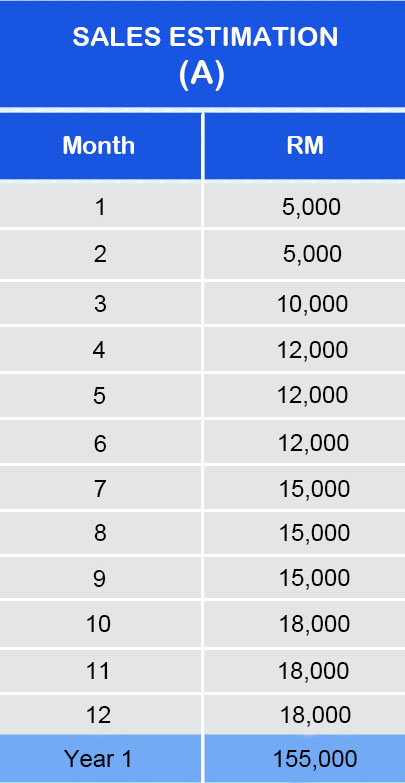

- Sales Estimation (A)

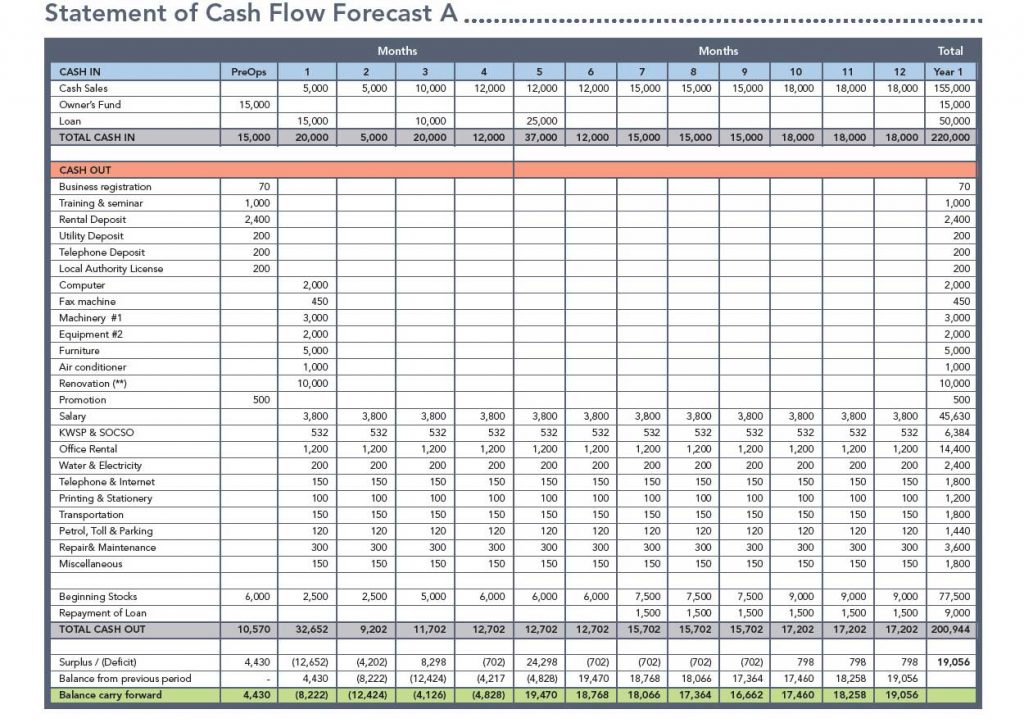

- Cost Estimation: Cost is estimated as per Business Investment Cost table (refer to page 58). Cost of stock will be 50% of the sales estimation. All operating costs are assumed to remain fixed monthly throughout the year. By using sales estimation A, let’s put together all the estimation in Statement of Cash Flow Forecast A.

With the estimation and assumptions, ABC Enterprise would not able to survive the first month of operation, though, at the end of the year, it will get a cash surplus of RM19,056. The reasons for the deficit could be due to the following factors:

Entrepreneurs have to think of cash flow forecast as part of ongoing business planning process. We can change the estimation from time to time to suit cash flow needs. A target can be set and work on to meet your daily, monthly or annually ideal cash surplus.

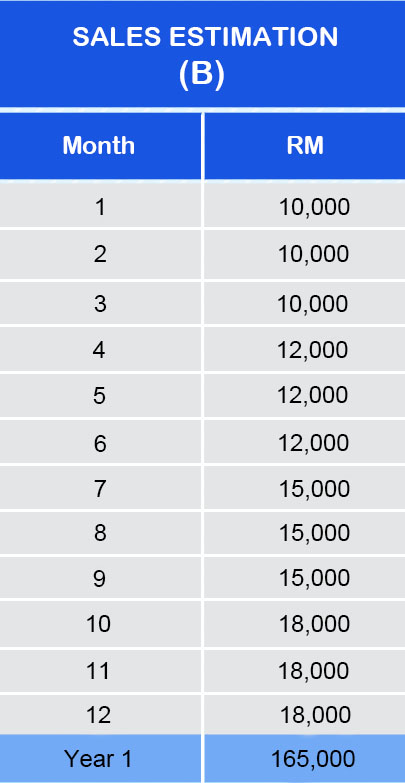

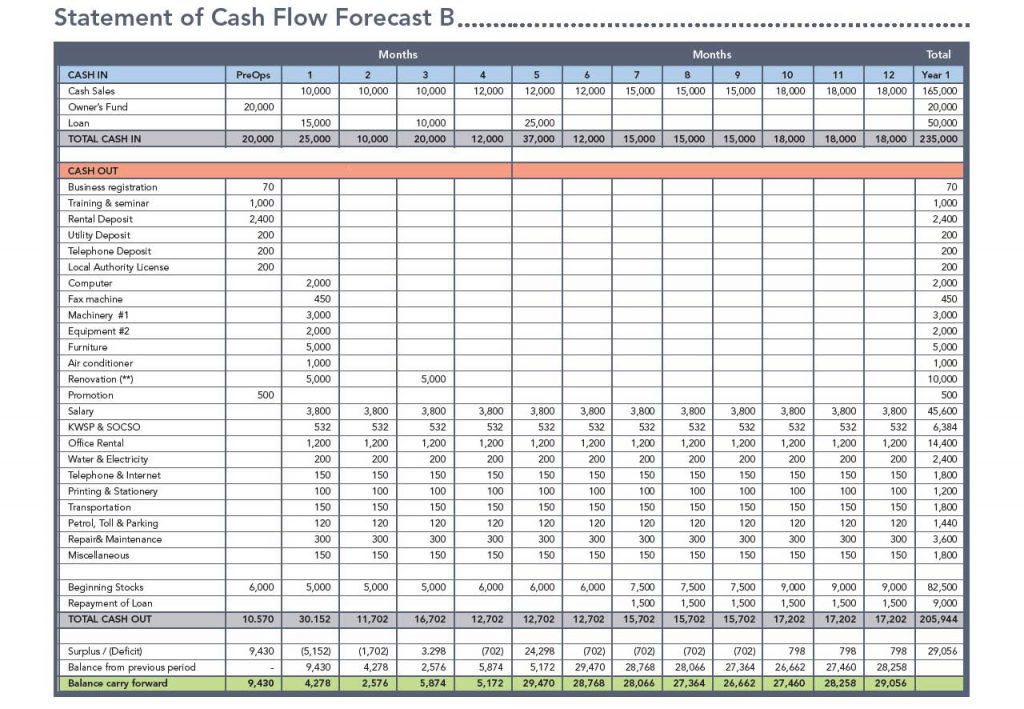

Let’s Say ABC Enterprise Revises Its Estimation And Targets For The Year.

-

- Sales estimation for the 1st and 2nd month is DOUBLED UP.

- Renovation cost to be paid is 50% on the 1st month and the remaining in the 3rd month.

- Owner will increase the initial fund by RM5,000.

- Other assumptions remain.

By using the revised estimation, let’s put together the revision in Statement of Cash Flow Forecast B.

With the revised estimations and assumptions, ABC Enterprise will have a positive statement of cash flows throughout the year with the year-end cash balance of RM29,056.00.

Financial Management Through Statement Of Cash Flow Forecast

The importance of preparing a statement of cash flows forecast is useful for both startup and existing businesses as the following:

Statement of cash flows reports all the in and out cash flows for a given accounting period. Statement of cash flows shows the changes in capital from the beginning of a year and breaks it down to sources and usage. It also can be categorized into three main activities: Non-Recurring Expenses, Fixed Assets, and Operating / Working Capital.

Information from the statement of cash flows further explains the transaction changes for the financial position (balance sheet) and comprehensive income (profit and loss statement).

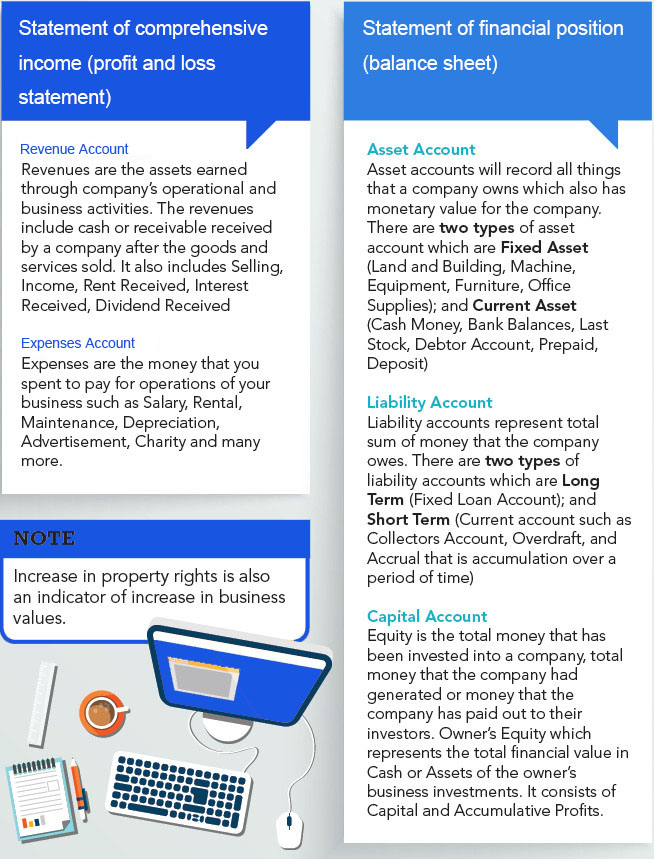

Types Of Account

There are 5 main groups of account. 2 accounts in the statement of comprehensive income (profit and loss statement) and 3 accounts in the statement of financial position (balance sheet).

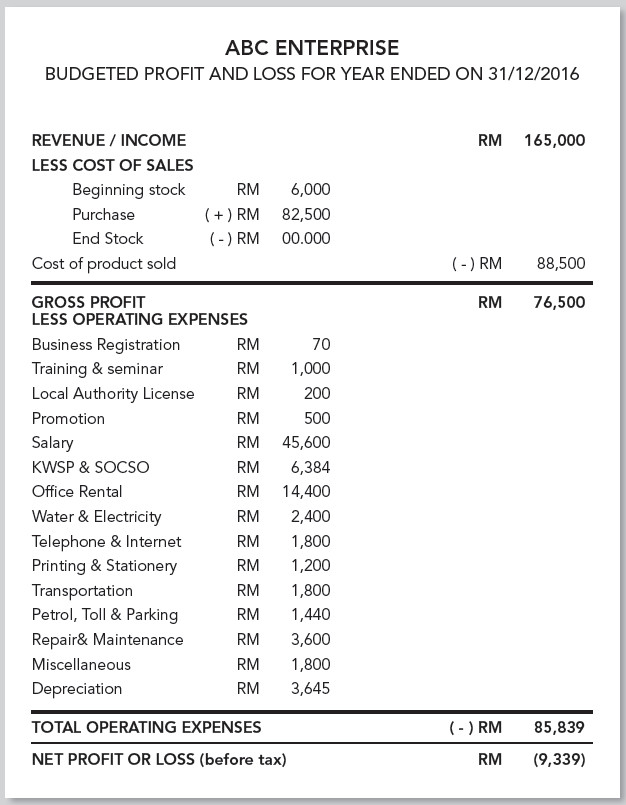

Statement Of Comprehensive Income (Profit And Loss Statement)

A statement of comprehensive income (profit and loss statement, P&L) is a financial statement that summarises the revenues, costs and expenses incurred during a specific period of time.

The above is correct on 14th October 2021.