It Take Money to make Money

- Home

- Managing The Finance Of Your Business

- It Take Money to make Money

It Takes Money to Make Money

Potential Sources Of Fund

Potential Sources Of Fund

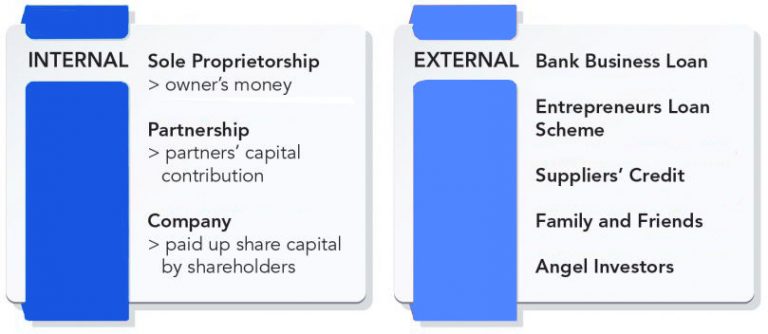

With the derived total amount of business investment cost, entrepreneurs now have to try to find the best way to fund the cost. Here are some potential sources of fund to consider for your startup.

Funding a business using own savings is good because you do not have to deal with other parties in starting your business. However, you probably will not have sufficient amount to sustain the business after a certain period of time hence other options should be considered.

Normally loan is involved when the business needs a large start-up cost. Entrepreneurs have to prepare a payback plan in time if borrowing money from external investors. There is a high chance also that owner has to give up some control (ownership) of the business to the investors.

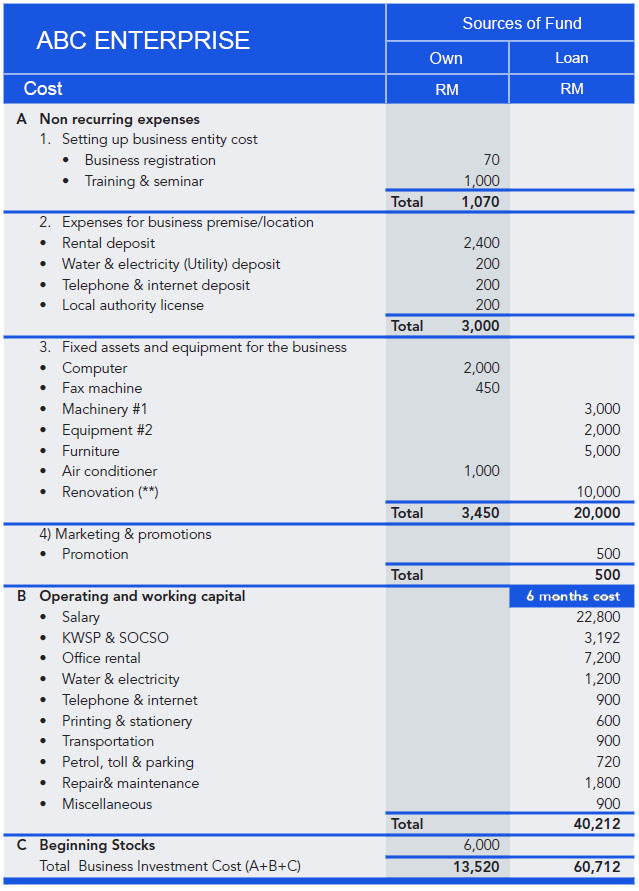

Now, using the same Business Investment Cost table formatting, add another column for “Sources of Fund”:

From the table, out of the total business investment cost of RM60,712, the amount RM13,520 will be funded by the owner and the remaining by a third party through lending.

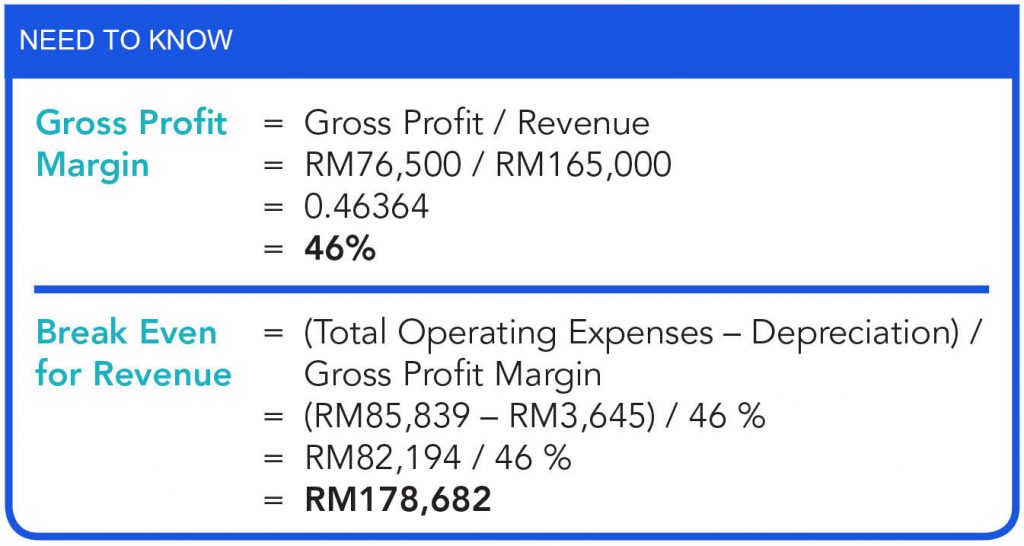

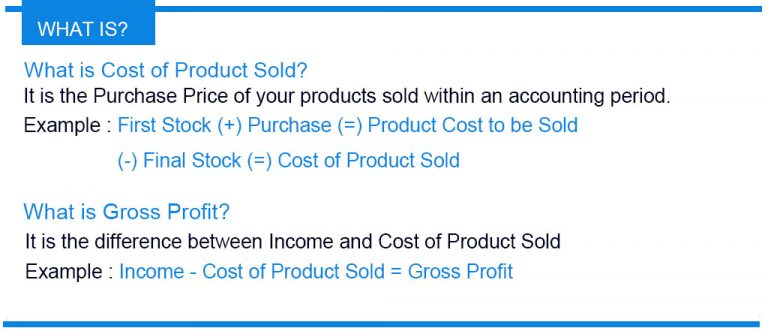

What Is Gross Profit Margin?

Gross Profit Margin is the difference between revenue and cost of products sold (include raw material, packaging, and production costs) or Gross Profit divided by Revenue and expressed as a percentage. The purpose of margin is to determine the value of incremental sales, to guide pricing and promotion decision.

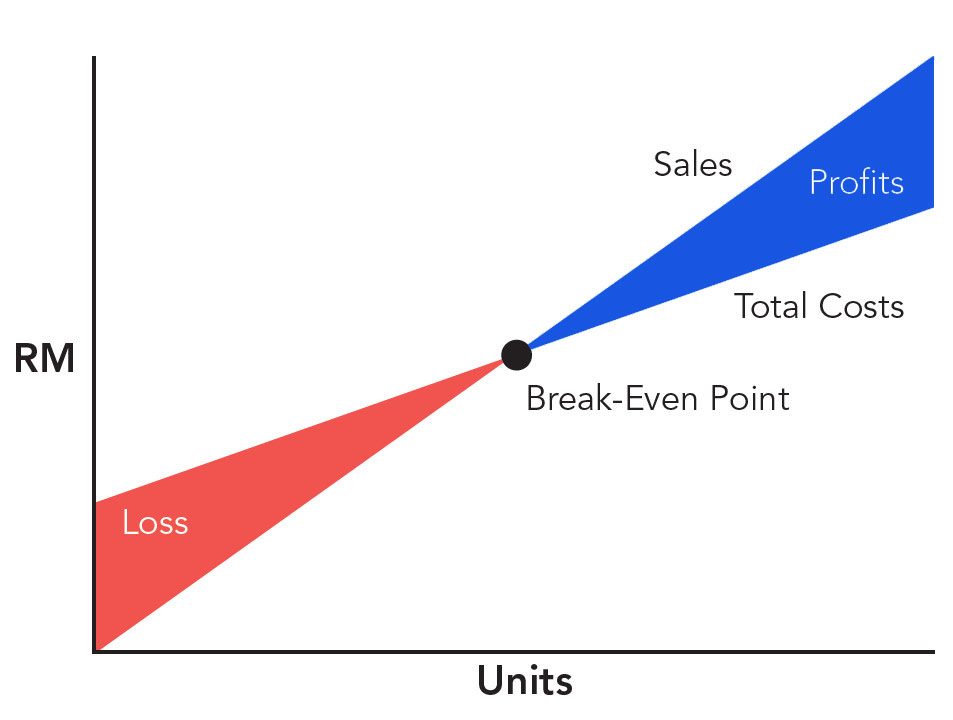

What Is Break Even For Revenue?

Breakeven is the point at which a business covers its costs. It refers to the number of product units must be sold or sales amount a business required to cover all costs. It is the point at which total cost and total revenue are equal to neither profit nor loss.

The purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to make a profit.

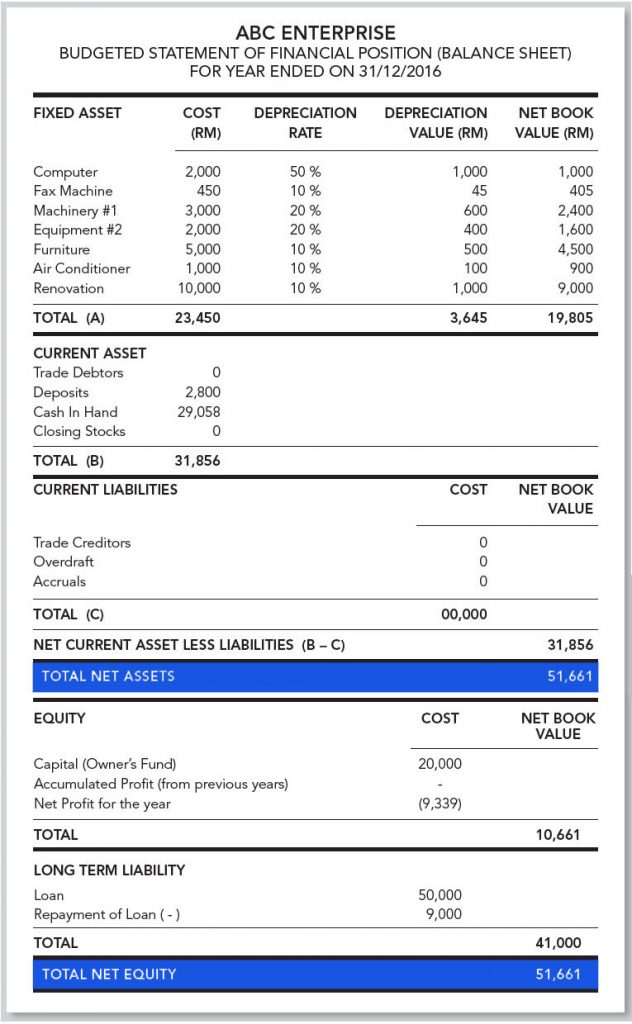

Statement Of Financial Position (Balance Sheet)

A statement of financial position (balance sheet) is a financial statement that shows what the business is worth for a specific period of time. It shows the total assets that a company owns and any amounts that it owes to lenders or bank which is called liabilities, as well as the amount of owner’s equity or capital.

The statement of financial position (balance sheet) has two sides that must be equal or balance each other out (Total Net Assets = Total Net Equity).

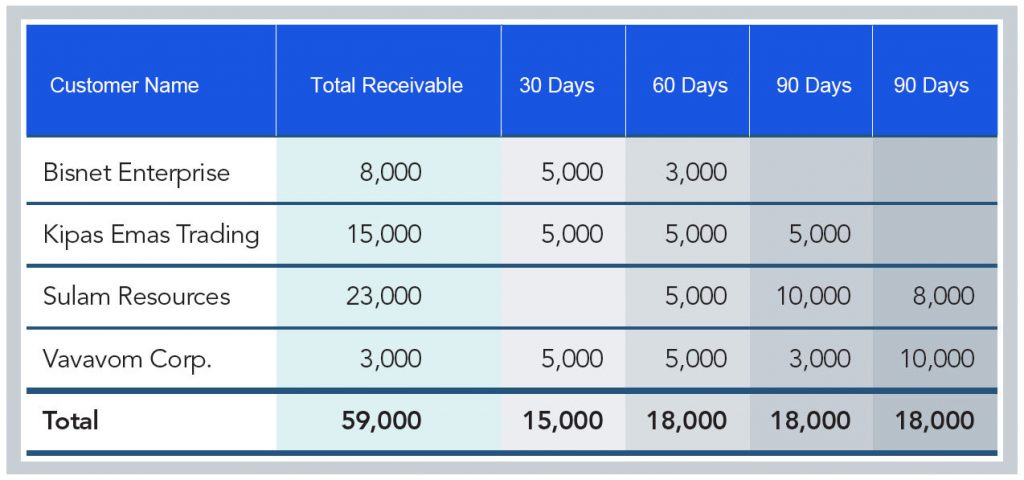

Account Aging

An account receivable aging is a report that lists your unpaid customer invoices that are overdue for payment and normally used as a primary tool by collections personnel.

The account payable aging report determining payable invoices which are overdue to your suppliers. These report commonly itemised in a period of time such as below example:

Receivable Aging Report

Payable Aging Report

The above is correct on 14th October 2021.